Step-by-step guide to help you report a foreign gift efficiently

Just How Legal Solutions Can Aid You in Reporting a Foreign Present: Trick Realities and Insights

Guiding via the complexities of reporting foreign gifts can be intimidating for companies and individuals alike. Legal services provide necessary know-how in understanding the complex laws that regulate these purchases. They help establish and recognize potential risks tailored conformity strategies. Lots of still encounter obstacles in guaranteeing adherence to these demands. This triggers the questions of how effective legal assistance can genuinely boost conformity and mitigate risks related to international present reporting.

Understanding the Legal Framework Surrounding Foreign Gifts

While the acceptance of international presents can improve global connections and foster cooperation, it additionally elevates intricate lawful factors to consider that institutions have to browse. The lawful structure controling foreign gifts incorporates numerous regulations and laws, which can vary markedly across territories. Establishments have to understand policies concerning the disclosure, appraisal, and potential taxation of these presents.

In addition, conformity with federal regulations, such as the Foreign Agents Enrollment Act (FARA) and the College Act, is essential for companies obtaining considerable foreign payments. These legislations aim to assure transparency and protect against unnecessary influence from international entities.

Additionally, establishments need to consider moral guidelines that control present approval to preserve integrity and public trust fund. By comprehending these lawful complexities, companies can better take care of the dangers connected with foreign presents while leveraging the opportunities they offer for global cooperation and partnership.

Secret Coverage Requirements for People and Organizations

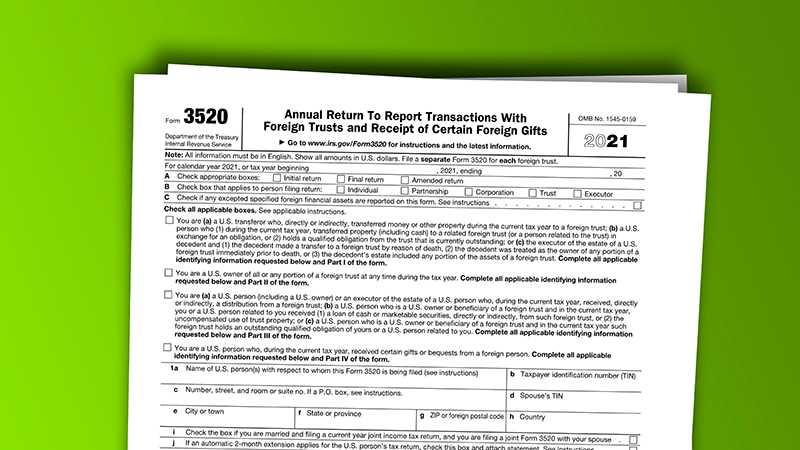

Organizations and people receiving international presents must stick to specific coverage needs to assure compliance with lawful commitments. These demands differ depending on the territory and the nature of the gift. Generally, recipients are mandated to divulge foreign gifts surpassing a particular monetary threshold to appropriate federal government firms. This might include in-depth details about the benefactor, the worth of the gift, and its intended usage.

In the United States, for example, the Foreign Professionals Registration Act (FARA) and the College Act impose unique reporting requirements - report a foreign gift. Organizations must make certain that their coverage straightens with appropriate regulations to stay clear of fines. Individuals may also need to report gifts received in their capacity as public officials or employees

Understanding these needs is vital, as failing to report properly can cause legal repercussions. As a result, appealing legal services can promote conformity and aid browse the intricacies of foreign gift reporting.

Usual Conformity Difficulties and Exactly How to Conquer Them

Maneuvering the intricacies of international gift coverage usually offers considerable compliance obstacles for receivers. One common concern is the uncertainty bordering the definition of a "foreign present," which can bring about unpredictability regarding what must be reported (report a foreign gift). Furthermore, differing state and federal regulations can make complex adherence to reporting needs, particularly for organizations running across territories. Receivers may additionally have problem with preserving accurate documents, as failure to record presents correctly can cause non-compliance

To get rid of these obstacles, recipients need to establish clear inner policies relating to websites international presents, guaranteeing all team are trained on conformity needs. Routine audits of present records can assist recognize discrepancies early. Furthermore, looking for guidance from conformity specialists can offer clearness on subtleties in regulations. By proactively attending to these hurdles, recipients can better browse the reporting process and lessen the risk of penalties linked with non-compliance.

The Duty of Legal Solutions in Navigating Foreign Gift Laws

Steering via the intricate landscape of foreign gift guidelines can be frightening, particularly given the potential legal ramifications of non-compliance (report a foreign gift). Legal services play an important function in assisting people and companies via this facility surface. They give expert evaluation of the applicable policies, guaranteeing clients completely comprehend their responsibilities relating to foreign gifts. Furthermore, attorneys assist in identifying potential risks and liabilities associated with non-disclosure or misreporting

Finest Practices for Ensuring Conformity With Foreign Gift Reporting

Conformity with foreign gift coverage needs necessitates a positive approach to prevent possible risks. Organizations must develop a clear policy detailing the criteria for determining and reporting international presents. Regular training for personnel entailed in the acceptance of gifts is crucial to guarantee they comprehend reporting commitments and the ramifications of non-compliance.

Additionally, keeping detailed documents of all international presents got, including the benefactor's objective, identification, and worth, is important. Organizations needs to implement a review process to evaluate whether a gift qualifies as reportable.

Engaging legal services can further bolster compliance initiatives, providing guidance on potential exceptions and intricate laws. Routinely evaluating and updating like this internal policies in line with regulatory adjustments will certainly assist organizations remain certified. Finally, promoting an organizational society that focuses on transparency in gift approval can alleviate dangers and enhance liability.

Often Asked Questions

What Kinds of International Gifts Call For Coverage?

Foreign presents needing reporting commonly consist of substantial financial contributions, residential or commercial property, or advantages gotten from foreign entities, federal governments, or individuals, specifically those exceeding details monetary limits set by laws, requiring openness to stop potential conflicts of passion.

Are There Fines for Failing to Report an International Gift?

Yes, there are charges for falling short to report a foreign present. The effects can include penalties, lawsuit, and possible damage to an individual's or company's reputation, highlighting the importance of compliance with coverage requirements.

Can I Get Legal Help for Foreign Gift Reporting Issues?

Lawful help may be readily available for people facing difficulties with international gift reporting problems. Qualification frequently depends upon economic need and particular scenarios, motivating potential recipients to get in touch with local legal aid organizations for help.

Just How Can I Track Foreign Present Received Gradually?

To track international presents with time, people must keep detailed records, including days, resources, and amounts. Frequently examining economic declarations and making use of tracking software program can boost precision and streamline reporting responsibilities.

What Documentation Is Required for International Gift Reporting?

Documentation for international present reporting normally consists of the contributor's information, gift worth, date received, a description of the gift, and any type of relevant correspondence. Exact documents guarantee conformity see post with coverage requirements and help protect against possible legal issues.

Organizations and people getting foreign presents should stick to certain reporting needs to ensure compliance with lawful obligations. Navigating through the detailed landscape of international present policies can be intimidating, specifically given the possible legal implications of non-compliance. By leveraging legal solutions, clients can browse the ins and outs of foreign present regulations extra successfully, consequently minimizing the threat of fines and promoting conformity. Legal help may be readily available for individuals dealing with challenges with international present reporting problems. Documents for foreign gift reporting typically consists of the donor's info, present value, date got, a description of the gift, and any kind of relevant communication.